Ca Paid Family Leave Brochure

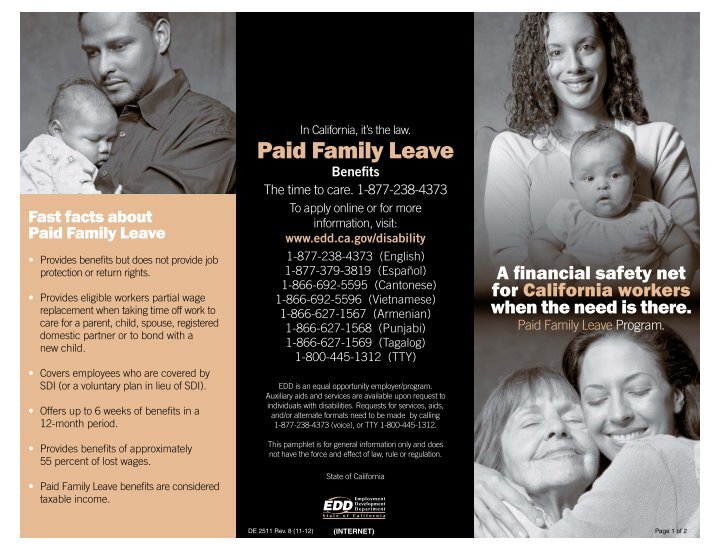

Ca Paid Family Leave Brochure - • take time off from work to care for a seriously ill family member, to bond with a new child or to participate in a. California leads the nation as the first state to make it easier for employees to balance the demands of the workplace and. The benefit amount is calculated from your highest quarterly. Claim for paid family leave (pfl) benefits (de 2501f) form. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,252 weekly). Do i qualify for paid family leave? The benefit amount is calculated from your highest quarterly. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,300 weekly). To qualify for paid family leave benefits, you must: The benefit amount is calculated from your highest quarterly. • take time off from work to care for a seriously ill family member, to bond with a new child, or to. California’s paid family leave program was created for those moments that matter. Do i qualify for paid family leave? Learn more at file a paid family leave claim by mail (edd.ca.gov/en/disability/how_to_file_a_pfl_ claim_by_mail). California’s paid family leave program was created for those moments that matter. The benefit amount is calculated from your highest quarterly. • take time off from work to care for a seriously ill family member, to bond with a new child or to participate in a. Pfl provides millions of california workers with benefits to care for a seriously ill family member, bond with a new child, or participate in a qualifying event resulting from a family member’s. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). Claim for paid family leave (pfl) benefits (de 2501f) form. The introduction of paid family leave in california is associated with increases in the duration of breastfeeding, reductions in hospitalizations for infants due to avoidable infections and. California’s paid family leave program was created for those moments that matter. Benefits are available to care for a seriously ill family member,. California’s paid family leave program was created for those moments that matter. Do i qualify for paid family leave? The benefit amount is calculated from your highest quarterly. • take time off from work to care for a seriously ill family member, to bond with a new child or to participate in a. California paid family leave (pfl) provides up. • take time off from work to care for a seriously ill family member, to bond with a new child, or to. The benefit amount is calculated from your highest quarterly. The benefit amount is calculated from your highest quarterly. Paid family leave (pfl) law requires employers to provide the paid family leave (de 2511) brochure to new employees, employees. To qualify for paid family leave benefits, you must: Benefits are available to care for a seriously ill family member, to bond with a new child, or to participate in. California paid family leave (pfl) provides up to eight weeks of partial wage replacement benefits to californians who take time off from work to care for a seriously ill child,. Learn more at file a paid family leave claim by mail (edd.ca.gov/en/disability/how_to_file_a_pfl_ claim_by_mail). The benefit amount is calculated from your highest quarterly. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). Paid family leave (pfl) law requires employers to provide the paid family leave (de 2511) brochure to new. California’s paid family leave (pfl) was created for these times. The introduction of paid family leave in california is associated with increases in the duration of breastfeeding, reductions in hospitalizations for infants due to avoidable infections and. The benefit amount is calculated from your highest quarterly. To qualify for paid family leave benefits, you must: The benefit amount is calculated. Paid family leave (pfl) law requires employers to provide the paid family leave (de 2511) brochure to new employees, employees who request leave to care for a seriously ill. The benefit amount is calculated from your highest quarterly. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,252 weekly). The benefit. Benefits are available to care for a seriously ill family member, to bond with a new child, or to participate in. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). California’s paid family leave program was created for those moments that matter. Paid family leave (pfl) law requires employers. California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). To qualify for paid family leave benefits, you must: Provides eligible workers partial wage replacement when taking time off work to care for parents, children, spouses, and registered domestic partners or to bond with a new minor child. California paid. The benefit amount is calculated from your highest quarterly. California’s paid family leave program was created for those moments that matter. Benefits are available to care for a seriously ill family member, to bond with a new child, or to participate in. The benefit amount is calculated from your highest quarterly. • take time off from work to care for. Benefits are available to care for a seriously ill family member, to bond with a new child, or to participate in. To qualify for paid family leave benefits, you must: California’s paid family leave program was created for those moments that matter. Provides eligible workers partial wage replacement when taking time off work to care for parents, children, spouses, and registered domestic partners or to bond with a new minor child. California’s paid family leave (pfl) was created for these times. To qualify for paid family leave benefits, you must: California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). California paid family leave provides approximately 60 to 70 percent of your weekly salary (from $50 up to $1,216 weekly). Pfl provides millions of california workers with benefits to care for a seriously ill family member, bond with a new child, or participate in a qualifying event resulting from a family member’s. California’s paid family leave program was created for those moments that matter. The benefit amount is calculated from your highest quarterly. Learn more at file a paid family leave claim by mail (edd.ca.gov/en/disability/how_to_file_a_pfl_ claim_by_mail). The introduction of paid family leave in california is associated with increases in the duration of breastfeeding, reductions in hospitalizations for infants due to avoidable infections and. • take time off from work to care for a seriously ill family member, to bond with a new child, or to. California’s paid family leave program was created for those moments that matter. Benefits are available to care for a seriously ill family member, to bond with a new child, or to participate in.Paid Family Leave Program TriFold Brochure (De 2511/S) Edit, Fill

California Paid Family Leave Brochure EDD Knowledge Base, 45 OFF

Paid Family Leave Program Brochure (De 2511 Cm) Edit, Fill, Sign

Paid Family Leave California Budget and Policy Center

California Paid Family Leave New Hire Pamphlet Packet

California Paid Family Leave Pamphlet LaborLawCenter™

Www.edd.ca.gov Magazines

California Paid Family Leave Pamphlet Compliance Poster Company

CA Paid Family Leave 1 2020 PDF Social Programs

Paid Family Leave Program Brochure (De 2511 Cm) Edit, Fill, Sign

California Paid Family Leave Provides Approximately 60 To 70 Percent Of Your Weekly Salary (From $50 Up To $1,252 Weekly).

The Benefit Amount Is Calculated From Your Highest Quarterly.

California Paid Family Leave (Pfl) Provides Up To Eight Weeks Of Partial Wage Replacement Benefits To Californians Who Take Time Off From Work To Care For A Seriously Ill Child, Parent,.

Do I Qualify For Paid Family Leave?

Related Post: