Fdic Brochure Your Insured Deposits

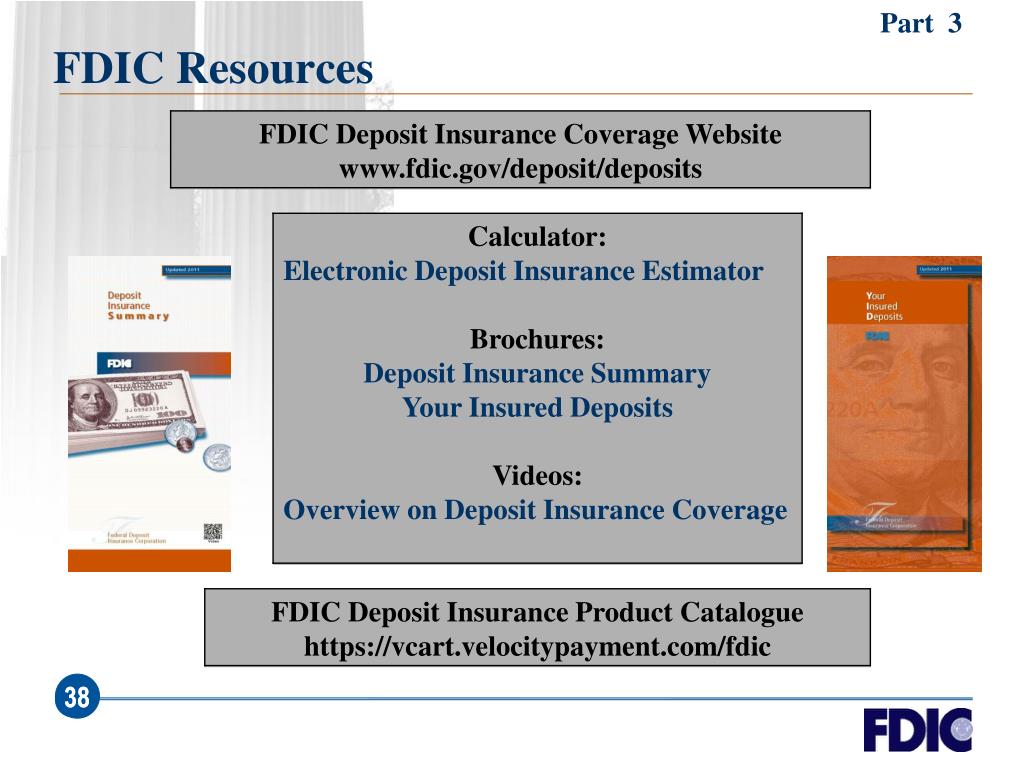

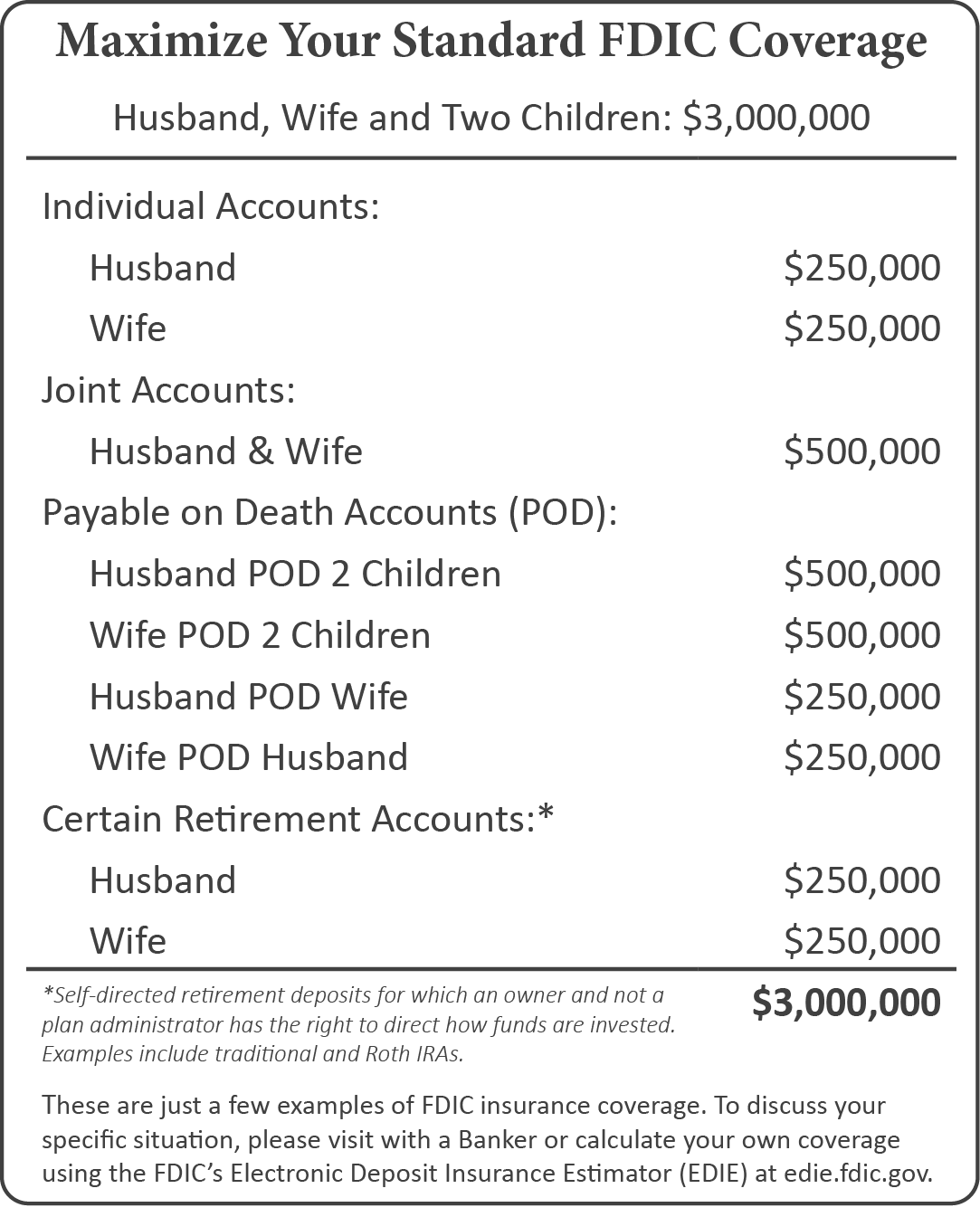

Fdic Brochure Your Insured Deposits - Since the fdic was founded in 1933, no depositor has. Your insured deposits is a. Citizen or resident to have his or her deposits insured by the fdic. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. About this brochure your insured deposits is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. Browse our collection of financial education materials, data tools, documentation. A person does not have to be a u.s. In the u.s., all federally chartered banks are required to have fdic insurance, and. Any person or entity can have fdic insurance coverage in an insured bank. This brochure is not intended as a legal interpretation of the fdic’s. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. A person does not have to be a u.s. Any person or entity can have. For additional or more specific information about fdic insurance coverage,. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. For additional or more specific information about fdic insurance coverage,. Any person or entity can have fdic insurance coverage in an insured bank. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. Your insured deposits is a. For additional or more specific information about fdic insurance coverage,. Any person or entity can have. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and. Your insured deposits is a. Citizen or resident to have his or her deposits insured by the fdic. Since the fdic was founded in 1933, no depositor has. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. For additional or more specific. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Since the fdic was founded in 1933, no depositor has. A person does not have to be a u.s. Your insured deposits is a. Sofi bank is a member fdic and does not provide more than $250,000 of fdic. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. Your insured deposits is a. Since the fdic was founded in 1933, no depositor has. Fdic insurance covers. Your insured deposits is a. This brochure is not intended as a legal interpretation of the fdic’s. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. The fdic charges banks a premium (or a. For additional or more specific information about fdic insurance coverage,. For additional or more specific information about fdic insurance coverage,. Any person or entity can have fdic insurance coverage in an insured bank. About this brochure your insured deposits is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. The fdic provides a wealth. Any person or entity can have fdic insurance coverage in an insured bank. Your insured deposits is a. Any person or entity can have. Whose deposits does the fdic insure? This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. The fdic charges banks a premium (or a fee) in exchange for providing deposit insurance. This brochure is not intended as a legal interpretation of the fdic’s. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. A person does not have to. A person does not have to be a u.s. Any person or entity can have fdic insurance coverage in an insured bank. This brochure is not intended as a legal interpretation of the fdic’s. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. For additional or more specific. Whose deposits does the fdic insure? This brochure is not intended as a legal interpretation of the fdic’s. Any person or entity can have fdic insurance coverage in an insured bank. A person does not have to be a u.s. This brochure is not intended as a legal interpretation of the fdic’s. Citizen or resident to have his or her deposits insured by the fdic. This brochure is not intended as a legal interpretation of the fdic’s. In the u.s., all federally chartered banks are required to have fdic insurance, and. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Any person or entity can have. Since the fdic was founded in 1933, no depositor has. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. The fdic provides a wealth of resources for consumers, bankers, analysts, and other stakeholders. For additional or more specific information about fdic insurance coverage,. About this brochure your insured deposits is a comprehensive description of fdic deposit insurance coverage for the most common account ownership categories. A person does not have to be a u.s. Fdic insurance covers all types of deposits received at an insured bank, including deposits in checking, now, and savings accounts, money market deposit accounts, and time deposits. Any person or entity can have fdic insurance coverage in an insured bank. Your insured deposits is a. This brochure your insured deposits describes federal deposit insurance corporation (fdic) deposit insurance coverage for the most common accounts ofered to. Sofi bank is a member fdic and does not provide more than $250,000 of fdic insurance per depositor per legal category of account ownership, as described in the fdic’s.FDIC Deposit Insurance Brochure 4 Panel Folded

PPT FDIC Seminar On Revocable Trust Accounts For Bankers PowerPoint

FDIC Booklet

Safe Sound and FDICInsured United Community Bank

FDIC’s Guide to Deposit Insurance Coverage Federal Deposit Insurance

FDIC Deposit Insurance Brochure 4 Panel Folded

FDIC Deposit Insurance at a Glance Brochure by Traditions Bank Issuu

Fdic Your Insured Deposits English PDF Federal Deposit Insurance

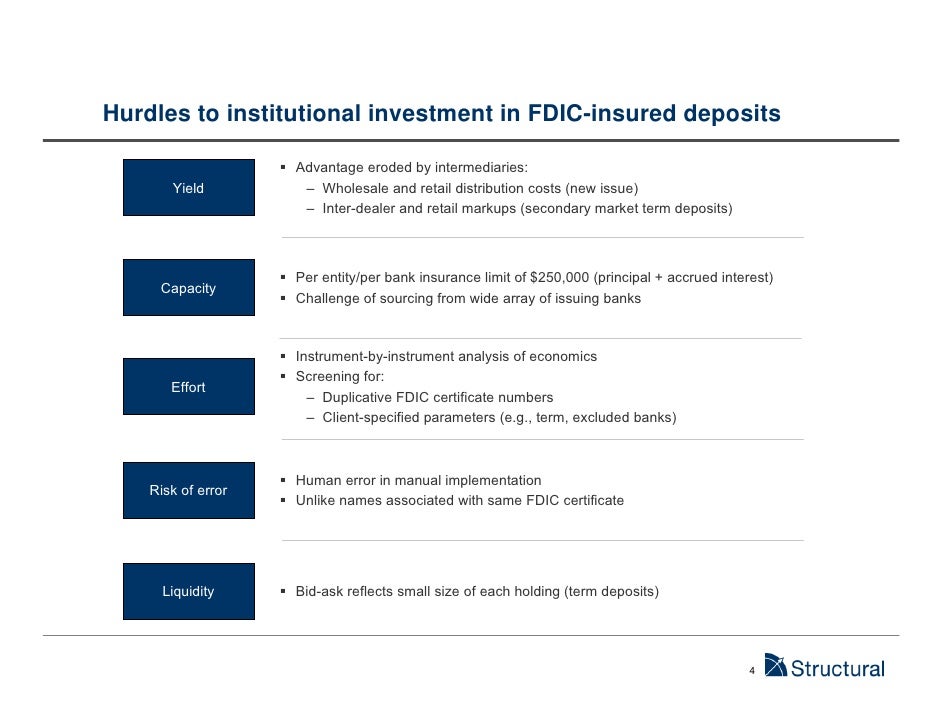

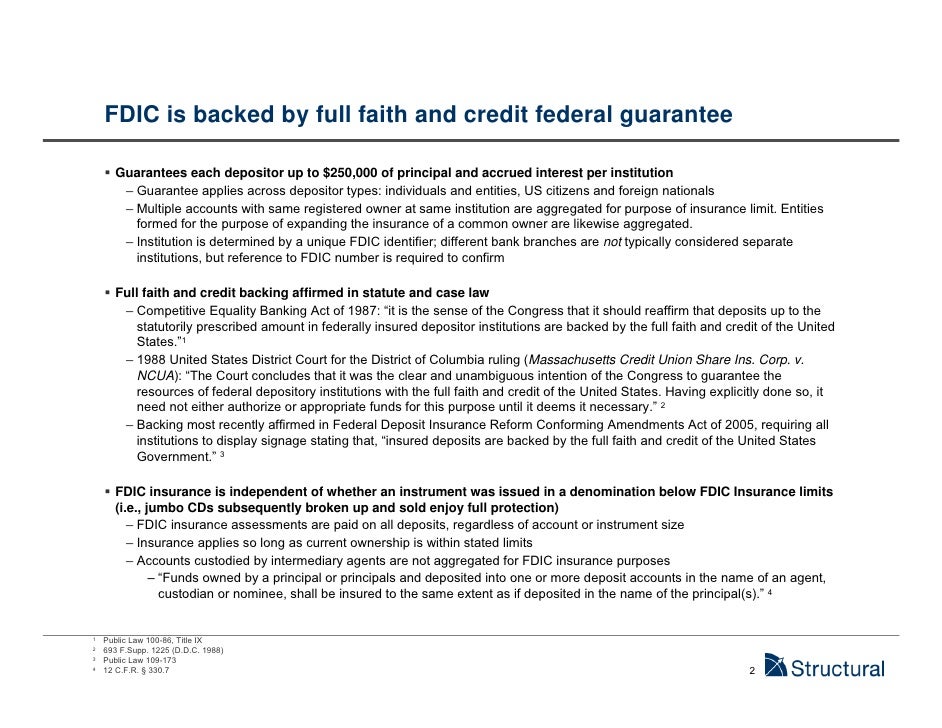

Structural FDIC Insured Deposits

Structural FDIC Insured Deposits

This Brochure Is Not Intended As A Legal Interpretation Of The Fdic’s.

Whose Deposits Does The Fdic Insure?

For Additional Or More Specific Information About Fdic Insurance Coverage,.

Browse Our Collection Of Financial Education Materials, Data Tools, Documentation.

Related Post: