Invesco Solo 401K Brochure

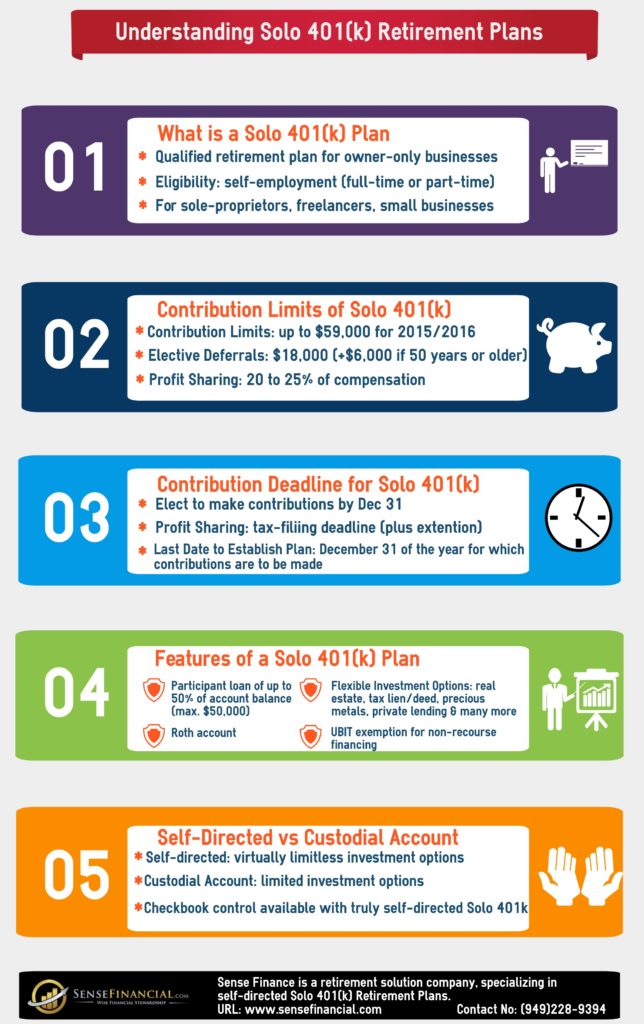

Invesco Solo 401K Brochure - Consistent income.downside risk mitigation.potential benefits:less volatility. Request a loan from an invesco solo 401(k) or 403(b)(7). Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional retirement program (orp). There’s a perfectly legal method to get to your retirement plan money at age 55 without paying a penalty, and it’s called the solo 401k. Invesco solo 401(k) ® participant enrollment form. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. Use this form to request a distribution from a participant’s solo 401(k) account. The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account or existing beneficiary status. Request a loan from an invesco solo 401(k) or 403(b)(7). Use this form to request a distribution from a participant’s solo 401(k) account. Avoid one size fits allfree webinarsflexible investments28 years of experience Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Then click the 'continue' button below. Safe harbor, age weighted, and new comparability. Invesco solo 401(k) ® participant enrollment form. It offers business owners greater savings potential than other small business retirement plans. The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. It offers business owners greater savings potential than other small business retirement plans. For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. Solo 401(k)® beneficiary transfer/distribution form use this form to request. We recommend that you speak with a tax advisor or financial professional regarding the consequences of this. Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account or existing beneficiary status. Invesco solo 401(k) secure 2.0 plan features and requirements document invesco solo 401(k) administrative. Request a loan from. Invesco solo 401(k) secure 2.0 plan features and requirements document invesco solo 401(k) administrative. Consistent income.downside risk mitigation.potential benefits:less volatility. Use this form to establish a participant account for the business owner (and spouse, if applicable) in. Avoid one size fits allfree webinarsflexible investments28 years of experience The invesco solo 401(k) product is still appropriate for your situation: Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative Invesco solo 401(k) and 403(b)(7) loan application and agreement: The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. Consistent income.downside risk mitigation.potential benefits:less volatility. • larger contribution limits and flexibility • roth component. Use this form to establish a participant account for the business owner (and spouse, if applicable) in. It offers business owners greater savings potential than other small business retirement plans. Invesco solo 401(k) and 403(b)(7) loan application and agreement: Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account. The invesco solo 401(k) product is still appropriate for your situation: • larger contribution limits and flexibility • roth component with no income limits • checkbook control •. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. Invesco solo 401(k)® participant enrollment form use this form to establish a participant account for the business owner (and. For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Then click the 'continue' button below. We recommend that you speak with a tax advisor or financial professional regarding the consequences of this. Consistent income.downside risk mitigation.potential benefits:less volatility. Invesco solo 401(k) ® participant enrollment form. The invesco solo 401(k) product is still appropriate for your situation: Then click the 'continue' button below. Discover the benefits, contribution types, investment options, and eligibility requirements for this powerful. There’s a perfectly legal method to get to your retirement plan money at age 55 without paying a penalty, and it’s called the solo 401k. Consistent income.downside risk mitigation.potential benefits:less. Consistent income.downside risk mitigation.potential benefits:less volatility. Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional retirement program (orp). Avoid one size fits allfree webinarsflexible investments28 years of experience Then click the 'continue' button below. Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative Safe harbor, age weighted, and new comparability. It offers business owners greater savings potential than other small business retirement plans. There’s a perfectly legal method to get to your retirement plan money at age 55 without paying a penalty, and it’s called the solo 401k. Consistent income.downside risk mitigation.potential benefits:less volatility. Use this form to establish a participant account for. The invesco solo 401(k) product is still appropriate for your situation: Invesco solo 401(k) secure 2.0 plan features and requirements document invesco solo 401(k) administrative. There’s a perfectly legal method to get to your retirement plan money at age 55 without paying a penalty, and it’s called the solo 401k. • larger contribution limits and flexibility • roth component with no income limits • checkbook control •. Use this form to designate or modify the beneficiary(ies) on your invesco ira (including traditional, roth, sep, sarsep and simple), 403(b) or optional retirement program (orp). Use this form to request a distribution from a participant’s solo 401(k) account. The invesco solo 401(k) offers the same savings potential of a 401(k) plan for a large company, but without the compliance requirements or administrative costs. Consistent income.downside risk mitigation.potential benefits:less volatility. Compared to regular iras, solo 401(k) plans offer a whole lot more for solopreneurs: Solo 401(k)® beneficiary transfer/distribution form use this form to request a transfer or distribution from a deceased participant’s solo 401(k) account or existing beneficiary status. Invesco solo 401(k) ® participant enrollment form. It offers business owners greater savings potential than other small business retirement plans. Then click the 'continue' button below. Required age 62+instant online quotepersonal 1 on 1 supportgreat heloc alternative For information on loans, see the invesco solo 401(k) and 403(b)(7) loan application and agreement, available online at invesco.com/us or by calling invesco client. Safe harbor, age weighted, and new comparability.How To Set Up Solo 401(k) Plans For SelfEmployed Workers

How To Set Up Solo 401(k) Plans For SelfEmployed Workers

Fillable Online invesco solo 401k form Fax Email Print pdfFiller

Solo 401(k) How it Works IRA Financial Group

Solo 401(k) Invesco US

Online access to Invesco Solo 401(k) plans

Solo 401(k) Thanks Modern Financial Advisors

Solo 401(k) Infographic A RealtorFriendly Retirement Plan

con ed 401k

Solo 401k Process (Flowchart)

Invesco Solo 401(K)® Participant Enrollment Form Use This Form To Establish A Participant Account For The Business Owner (And Spouse, If Applicable) In An Invesco Solo 401(K) Plan.

To Get Started, Enter The Provided User Name And Password.

Discover The Benefits, Contribution Types, Investment Options, And Eligibility Requirements For This Powerful.

Invesco Solo 401(K) And 403(B)(7) Loan Application And Agreement:

Related Post: