Roth Ira Brochure

Roth Ira Brochure - Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. Search by title, subject, literature number, fund or cover description. There are two types of individual retirement arrangements (iras): Printed materials from wolters kluwer help you stay compliant, simplify your processes and. You must log in to order. Use this brochure to educate clients on the features and benefits of a roth ira. A roth ira is an ira that, except as explained below, is subject to the rules. Pmc’s brochures provide your customers and prospects with concise overviews of how. Explore the differences between a traditional ira and a roth ira and decide which one is. What is a roth ira, and how does it work? The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. Search by title, subject, literature number, fund or cover description. Prepare for your future with a roth ira. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Use this brochure to educate clients on the features and benefits of a roth ira. Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Pmc’s brochures provide your customers and prospects with concise overviews of how. A possible tax credit of up to $1,000. Distributions of earnings from roth iras are free of income tax, provided you. There are two types of individual retirement arrangements (iras): Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Use this brochure to educate clients on the features and benefits of a roth ira. Prepare for your future with a roth ira. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Search by title, subject, literature number, fund or cover description. You must log in to order. What is a roth ira, and how does it work? Distributions of earnings from roth iras are free of income tax, provided you. Pmc’s brochures provide your customers and prospects with concise overviews of how. A possible tax credit of up to $1,000. Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Printed materials from wolters kluwer help you stay compliant, simplify your processes and. You must log in to order. Distributions of earnings from roth iras are free of income tax, provided you. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. What is a roth ira, and how does it work? A possible tax credit of up to $1,000. Explore the differences between a traditional ira and a roth ira and decide which one is. Prepare for your future with a roth ira. Use this brochure to educate clients on the features and benefits of a roth ira. Search by title, subject, literature number, fund or cover description. Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Investment toolsmarket insightsdigital investing programactively managed funds Distributions of earnings from roth iras are free of income tax, provided you. Explore the differences between a traditional ira and a roth ira and decide which one is. A roth ira is an ira that, except as explained below, is subject to the rules. There are two types of individual retirement arrangements (iras): What is a roth ira, and how does it work? Search by title, subject, literature number, fund or cover. Investment toolsmarket insightsdigital investing programactively managed funds You must log in to order. What is a roth ira, and how does it work? Search by title, subject, literature number, fund or cover description. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. A roth ira is an ira that, except as explained below, is subject to the rules. Prepare for your future with a roth ira. Pmc’s brochures provide your customers and prospects with concise overviews of how. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Explore the differences between a traditional ira and a roth ira. A roth ira is an ira that, except as explained below, is subject to the rules. Pmc’s brochures provide your customers and prospects with concise overviews of how. Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Search by title, subject, literature number, fund or cover description. A possible tax credit of up to $1,000. A roth ira is an ira that, except as explained below, is subject to the rules. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Pmc’s brochures provide your customers and prospects with concise overviews of how. Investment toolsmarket insightsdigital investing programactively managed funds Search by title, subject, literature number, fund or cover description. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. There are two types of individual retirement arrangements (iras): Explore the differences between a traditional ira and a roth ira and decide which one is. Distributions of earnings from roth iras are free of income tax, provided you. You must log in to order. A possible tax credit of up to $1,000. Prepare for your future with a roth ira. Pmc’s brochures provide your customers and prospects with concise overviews of how. Investment toolsmarket insightsdigital investing programactively managed funds What is a roth ira, and how does it work? Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives.Straight Answers to Your Roth IRA Questions Wolters Kluwer

Roth IRA Benefits, Rules, and Contribution Limits 2025

What is a backdoor Roth IRA? The Aero Advisor

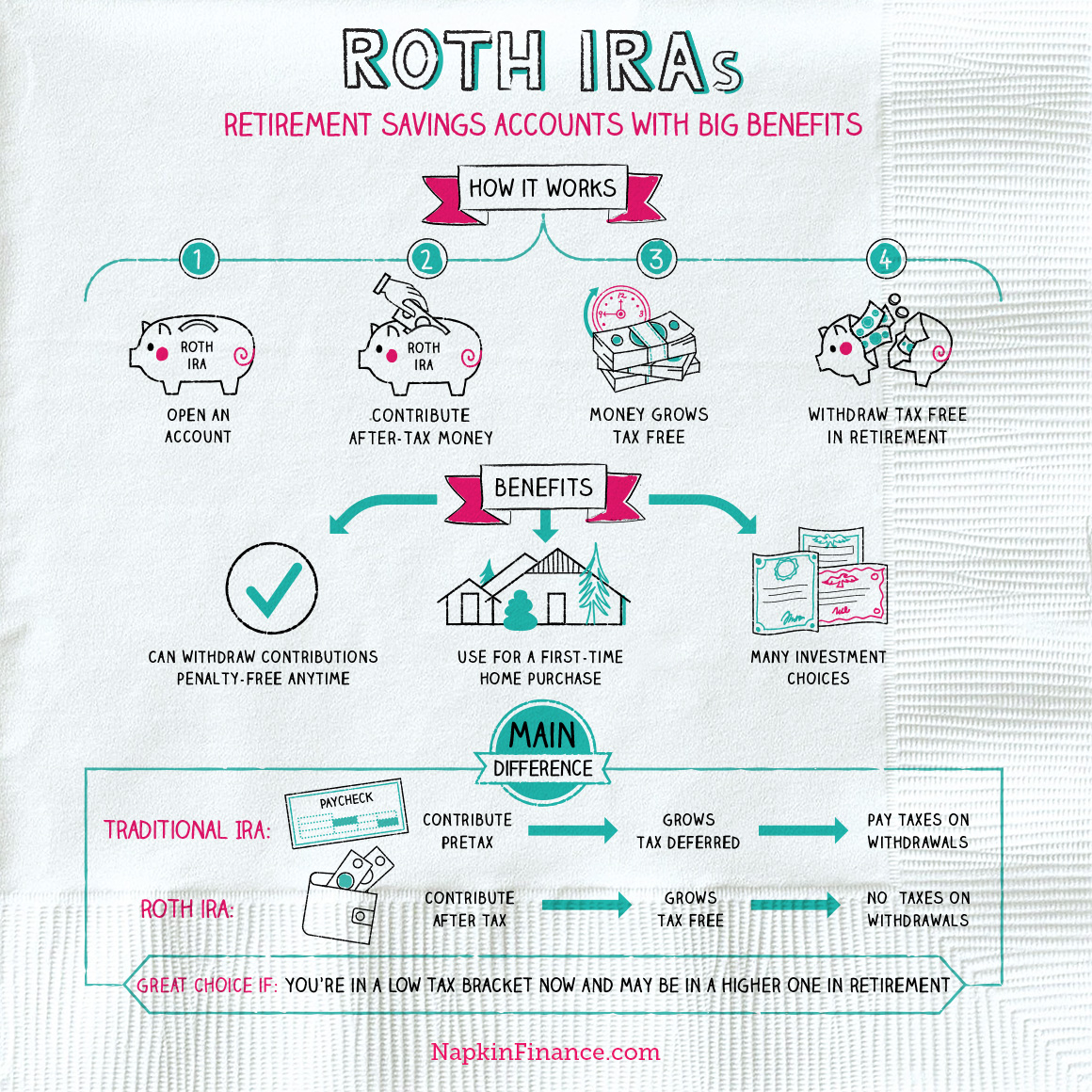

Roth IRAs Napkin Finance

Roth IRA Brochure Wolters Kluwer

Roth IRA explained, and the 4 biggest benefits Ladies Get Paid

2014 roth ira brochure by Hudson River Community Credit Union Issuu

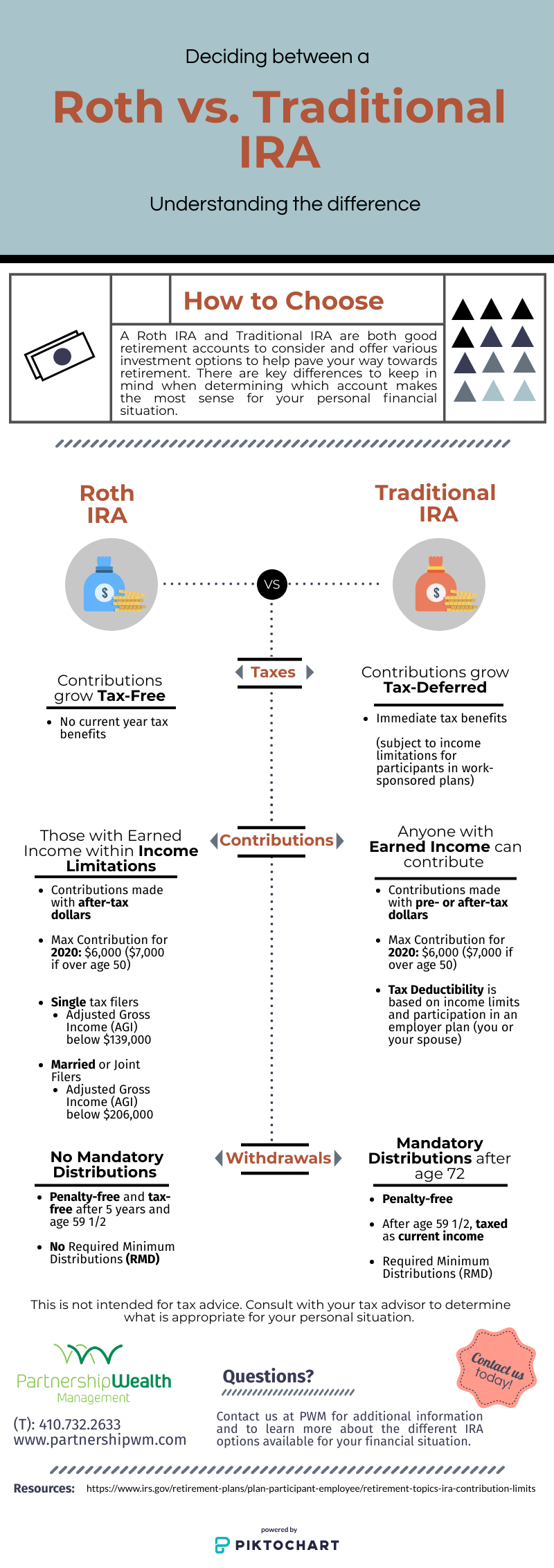

Roth IRA vs. Traditional IRA

Quick Start Guide to a SelfDirected Roth IRA (Infographic) Finance

The Ultimate Roth IRA Guide District Capital Management

Use This Brochure To Educate Clients On The Features And Benefits Of A Roth Ira.

A Roth Ira Is An Ira That, Except As Explained Below, Is Subject To The Rules.

Search By Title, Subject, Literature Number, Fund Or Cover Description.

Related Post: